A wave of retail theft and violence is reshaping the conversation around shrink.

It’s no longer just a budget line item—it’s a catalyst for store closures, employee trauma, and disrupted communities. And as incidents grow more aggressive and coordinated, the need for a unified response has never been greater.

In 2024 alone, U.S. retailers lost an estimated $45 billion to shoplifting. Moreover, 91% of the retailers surveyed for a National Retail Federation report in 2024 said aggression tied to shoplifting has increased.

This post looks at what’s behind the surge in a more virulent form of retail shrink, how it impacts people and operations, and what strategies are emerging in response.

Shrink defined: What it means—and why it matters

Retail shrink refers to preventable inventory losses experienced by a retailer—typically caused by human error or theft. In simple terms, shrink is the disappearance of inventory that doesn’t result in a sale.

Various methods can be used to calculate exact numbers, but in general, it can be understood like this:

Retail shrink rate = (retail shrink value) / (optimal retail value of products)

External theft—and the rise of organized retail crime

While some loss is considered a cost of doing business (e.g., expired goods, breakage, and even internal theft), today’s retail environment is increasingly shaped by external theft, which includes shoplifting as well as organized retail crime.

A closer look at external theft

Shoplifting refers to merchandise theft from a sales floor during the hours of business operation. Arizona State University’s Center for Problem-Oriented Policing notes that offenders typically fall into one of three groups:

- Petty thieves. Casual shoplifters—often juveniles—who steal impulsively for personal use and may not view their actions as harmful.

- More determined thieves. These offenders steal regularly to support drug habits or generate cash for income, often using basic concealment tactics and reselling through informal local channels.

- Organized groups. Typically operating across regions with assigned roles, tools, and shopping lists, they carry out high-volume thefts and move goods through layered resale networks.

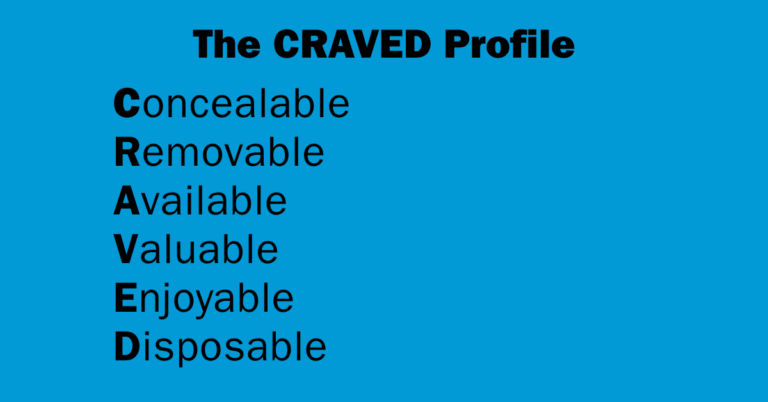

What shoplifters look for: The CRAVED profile

According to Rutgers University criminologist Ronald V. Clarke, PhD, the most commonly shoplifted items can be described as having one or more of the following attributes. These make up the acronym CRAVED:

How is the actual act of theft carried out? Although shoplifting techniques vary, they typically involve one of the following:

- Concealment or hiding goods in loose clothing or a bag

- Using box devices or specially designed “booster” bags

- Palming, substituting, and switching

- Bold snatch-and-grab exits

How ORC became retail’s most aggressive threat

Snatch-and-grab thefts (see final bullet above) are becoming more brazen and violent. Many of these incidents are tied to organized retail crime (ORC)—large-scale theft rings that target products for resale through online or underground markets.

The 2024 NRF report underscores that ORC is becoming more aggressive and sophisticated. Offenders are not lone shoplifters, but coordinated groups operating across multiple states and locations.

Among retailers tracking ORC, incidents rose by an average of 57% from 2022 to 2023.

Actions taken to combat online resale of stolen goods

Curbing the online resale of stolen merchandise remains a major challenge. However, the INFORM Consumers Act, which took effect in June 2023, marks a step forward—giving law enforcement better tools to identify and trace high-volume sellers.

Michael Hanson, Sr. EVP of Public Affairs at the Retail Industry Leaders Association (RILA), called the legislation “a tremendous accomplishment,” while noting that “there is still work to be done.” He emphasized the importance of continued collaboration between retailers, law enforcement, and the Federal Trade Commission to ensure the law is fully enforced and effective.

The human cost of shoplifting

Shoplifting is sometimes framed as a “victimless crime”—but its consequences can be devastating for employees in particular.

While many retailers now advise employees not to intervene in theft incidents, violence against store associates continues to rise: According to the 2024 NRF report, between 2022 and 2023, retailers tracking violence-related data reported:

- An increase of 42% in shoplifting incidents involving threats or actual violence

- An increase of 39% in cases involving a weapon

More broadly, 73% of retailers said shoplifters are more aggressive than a year ago, and 91% said that aggression has risen since 2019.

But the fallout goes beyond the violence itself—it affects morale, turnover, and the long-term health of store teams.

Burnout and breakdown on the sales floor

A 2024 RILA study on theft reporting also sheds light on the emotional toll that theft is taking on retail employees. Focus group insights revealed that store teams are experiencing widespread burnout, fear, and frustration in response to rising theft and limited support.

Participants also described store associates as feeling “desensitized” and “disheartened” as well as uncertain about how to respond. High turnover, gaps in training, and strained internal resources were noted as compounding the difficulty of maintaining stable, well-supported teams.

The broader impact: Economics, operations, and communities

Shrink isn’t just a store-level problem—it affects the economy at large. Rising theft translates into national-level financial strain, influencing prices, tax revenue, and employment.

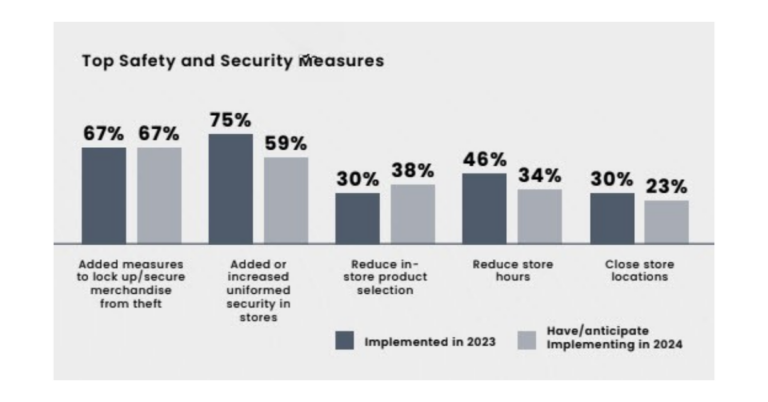

Meanwhile, retail theft continues to impose significant financial burdens on the industry. This surge in theft has led to increased operational costs for retailers, including heightened security measures and inventory management challenges, as the chart below shows.

Ultimately, shrink affects store policies, labor, and the customer experience. The ripple effect extends to local communities, where store closures due to theft can limit access to goods and services.

Facing theft head-on: What’s next for your stores

Retail theft is more than a budget issue—it’s a growing crisis that’s impacting store teams, shopper trust, and everyday operations. Solving it takes more than hardware or headlines. It calls for thoughtful planning, proactive support for associates, and smarter store environments that deter theft while also staying welcoming to customers.

Here are just a few of the tactics retailers are using to take action:

Tighter stock controls. Tagging systems, inventory tracking, and anti-theft devices help prevent losses across a wide range of products.

Upgraded security practices. Clearly defined procedures—like bag sealing, receipt checks, and supervised fitting rooms—reduce opportunities for theft.

More secure displays. Durable, impact-resistant showcases can slow down or even thwart theft attempts without compromising the shopper experience.

Ultimately, reducing theft isn’t about any one fix. It’s about combining the right tools, training, and design choices to create safer, stronger stores. When your people feel supported—and your products are protected—you’re not just fighting loss. You’re reinforcing everything that makes retail work.